If the late Steve Jobs can get fired from the company he helped build, then you should really take job security and sudden unemployment seriously. The Apple co-founder isn’t the success story, which started off with being fired from a job. The Queen of All Media, Oprah Winfrey, was sacked from her evening news reporter job because she was “unfit for television news.” Harry Potter writer J.K. Rowling was fired from her Amnesty International desk job supposedly for daydreaming too much. And would you believe that Walt Disney was handed the pink slip because he “lacked imagination and had no god ideas.” The people who fired them must be spinning in their graves right now.

As inspiring as these people are, not everyone has gifts and talents they can make use of in case of sudden unemployment. In the film Up In the Air, George Clooney and Anna Kendrick played hatchet men (and women), people hired to fire workers from their particular company. One fellow, played by J.K. Simmons, was let go but ended up pursuing his passion of being a chef. Meanwhile, another person committed suicide.

It’s entirely up to you how you would react to being fired. You can take this as a wake-up call and an opportunity to do other things or you can just wallow in your misery and give up entirely. Of course, the latter shouldn’t even be a choice. You don’t want to be jumping off a bridge or anything.

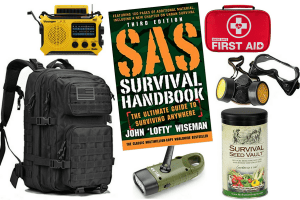

What you can do is to prepare for sudden unemployment should it happen. Most preppers prepare for natural disasters and other emergency situations. Some forget that sudden unemployment can be as tragic despite the lack of blood and gore.

Watch Out for the Signs

You should always be ready for sudden unemployment whether you think things are going well or not with the company. But when you start to notice the warning signs, it’s time to ramp up your preparations.

Employees are Being Laid Off

If the company has been firing people left and right, this should be a clear sign that your job is not safe. Restructuring is another sign that people will be let go.

Company is Cutting Expenses

Another warning sign that may end in your sudden unemployment is that the company is cutting down on the expenses. This will be obvious once expenses need to be approved first.

A New Boss

In most cases, a new boss or the company being taken over by another company means change is coming. And that change may not be good for you.

If there’s a new boss in town, chances are he or she is looking to make some personnel changes to suit their needs. This may be a problem especially if you were close with the old one. When it comes to mergers and acquisitions, there’s a chance that your job is redundant with someone else from the other company. Either you or the other person will be handed the pink slip.

People are Quietly Leaving

If you notice that the senior managers in the company are leaving, don’t think of this as an opportunity for you to advance your career. Chances are, they are leaving because they know the company is a sinking ship. If you’re one of the good ones, this may be the case. But if your job is expendable, you could also be leaving soon but not because it was our choice.

Pay Off Debts

It’s common for families to have debts. It’s also important to settle your debts before anything utoward happen, such as sudden unemployment. Simply put, without a job, you’ll have a hard time paying off all your debts. This may lead to your properties and assets being sequestered.

Decide on a particular time period in which you should settle all debts. Give yourself, say a year from now to pay everything off. Stick to this plan no matter what. You’ll heave a huge sigh of relief once the year is over.

Save Money

Set aside a portion of your salary for your savings. Choose a bank that will make the most out of your hard-earned moolah. It’s important to have some money set aside in case of sudden unemployment. When the money is no longer coming in, the expenses don’t stop. So it’s vital you still have some to pay the bills and buy groceries while you’re looking for another job.

Some experts recommend that you have 3 to six months’ worth of expenses in the bank for your emergency fund. Ideally, you should have more money set aside that you won’t dip into unless really necessary.

Re-evaluate Your Budget

You don’t want to spend money you don’t have. It’s even worse of you end up paying debts with money you don’t have. First of all, be wise in how you spend your hard-earned cash. Take a deep look at your daily and monthly expenses and set a new budget that will let you save money but still eat well.

Put premium to paying off debts, savings, and food and water. Of course, you still have to pay the bills so they should be among your priorities.

Go for the Simple Life

Paris Hilton and Nicole Ritchie you are not. That means you can live the simple life better than these two. To do that, make a list of the things you do that can be considered luxury. Avoid eating out or partying with friends. Your spouse will surely understand if you can’t go to a fancy dinner like you used to. Just make something nice at home for your date night and spend it talking, watching a good film, and cuddling.

You should also look at the things you can do without. Cable, for example, should save you around $100 a month, more or less. That’s huge. If you can take the heat, turn of the airconditioner. Do you like long shows? Maybe it’s time you take quick baths instead.

Reconsider Major Purchases

The moment you feel that your job is in jeopardy, you should take a second to analyse your expenditures. If you’ve been planning on getting a new car or even a new state of the art TV set, you may want to reconsider.

Stock Up On Food and Water

The good thing about prepping is you have food and water when it’s impossible to buy them. If there’ a hurricane, for example, you can’t just go out to buy food and water. The same goes if the world is overcome by zombies or aliens. You’d be taking a risk going out of your shelter and scavenging for your basic needs.

When it comes to sudden unemployment, the supplies you have in your prepper pantry will help keep you afloat while there’s no money coming in.

If you’re able, buy supplies in bulk. This will be a good way to jumpstart your prepper pantry. Realistically, however, not everyone can afford to spend too much on something. What u can do is to buy a little extra every time you do the grocery. An extra bottle of water and a few canned goods won’t hurt your pockets that much but will go a long way if kept in your pantry.

Be More Self-Sufficient

There are food items you can grow on your own instead of buying it at an expensive price from the supermarket. Start with something simple as growing herbs and vegetables from scraps. Don’t throw away the bottom part of the lettuce. Soak it in a few centimeters of water and watch as it grows new leaves. Other vegetables you can grow from scrap include potatoes, bok choy, celery, lemongrass, avocado and ginger. You can also start your own garden with seeds and seedlings.

As you go along, you can even start raising animals for food and other resources such as milk and eggs. Some preppers have taken an interest in aquaphonics. You should, too.

Stock Up On Non-Food Items

Aside from food and water, you should also stock up on other important needs. Medicines, for example, may cost a lot especially those needed for specific medical conditions. If you’re suffering from one, make sure you have enough stock of your meds to last you even if you no longer have a job. Aside from the prescribed medicines, you should also hoard other medical items.

Other non-food items that you should be stockpiling at home include toiletries, feminine products, laundry materials, pet food, toilet paper, and more.

What else do you think can be done to prepare for sudden unemployment? If you have any suggestions, please comment below. And if you want to learn more about the things preppers are preparing for, please visit The Gentleman Pirate.

Just a disclaimer – We have partnered with these companies because we use their products and/or proudly trust and endorse them – so we do receive a commission if you make a purchase or sign up for services.

Often, we are able to negotiate special discounts and/or bonuses, which we will pass on to you via our links. We often get short notice on sale items available for 24-48 hours as we will pass these savings onto you.